Fundación Mustakis

From Philanthropy to ESG Investing

Fundación Mustakis

From Philanthropy to ESG Investing

Chile / Foundation

Fundación Mustakis (Chile) is an example of the different roles a traditional philanthropic organization can play along the continuum of capital. The Foundation achieves this by supporting other organizations and initiatives through three programs designed to support different stages and needs usually seen in impact-generating organizations. It also innovates in the way it achieves financial sustainability by making socially and environmentally responsible investments with its endowment, which opens up the possibility of creating impact through innovative finance channels.

%203_43_42%20p_%C2%A0m_.png)

Overview

As in other Latin American countries, Chile has grown the impact investment ecosystem over the past ten years. The role of foundations has been key to this growth because of their philanthropic nature and their ability to take on risks and create innovation.1 Yet, only 12% of Chilean foundations allocate resources to organizations that aim to solve a social or environmental issue and achieve a financial return.2 This reveals an opportunity for traditional philanthropy foundations and organizations to engage more in impact investment ecosystem by providing philanthropic capital to help dynamize and catalyze the ecosystem by attracting other stakeholders.

Foundations are under-represented in the Chilean impact investment ecosystem mainly due to the country’s legal system. Beyond donations, the legal system limits the use of flexible financial instruments to provide resources to third parties expecting financial returns. Furthermore, this system involves high transaction costs for organizations and, as a result, hinders the mobilization of potential donors toward venture philanthropy.3 However, organizations such as Fundación Mustakis have innovated in the use of various self-financed instruments by resorting to, for example, their endowment to finance third parties through mechanisms other than donations.

Fundación Mustakis is one of the philanthropic organizations that have started exploring other social investment models by financing third parties to enhance impact beyond the implementation of its programs. The Foundation’s goal is to promote a comprehensive development of children and youth through its in-house programs and to support the development of other organizations, social enterprises, and initiatives seeking to meet social challenges related closely to poverty and inequality.

When it was established in 1997, Fundación Mustakis gave occasional donations, but later, in 2013, it began experimenting with venture philanthropy. This allowed the Foundation to contribute to social development by supporting social businesses and other foundations with impact business potential.

For instance, the Foundation started providing assistance and financial support to traditional social businesses, triple-impact businesses, and non-profit organizations in 2016. The Foundation’s venture philanthropy approach is based on providing tailored counseling, training sessions, and seed capital to finance projects that might positively impact the reality and scope of the business. One of the first beneficiaries supported under the venture philanthropy approach was Co-Emprende, an organization that aims to bridge the financial access gaps faced by social businesses from La Pincoya and Recoleta communities in Santiago.

Financial and non-financial support provided by the Foundation to Co-Emprende is determined by annual agreements. While these agreements do not set forth Fundación Mustakis’s direct participation in Co-Emprende’s governance body or portfolio, the Foundation does maintain a close relationship as a partner to guide and provide strategic advice. Additionally, Co-Emprende set results and impact indicators regarding end beneficiaries from the outset for proper follow-up.4

1 Aninat, M., Fuenzalida, I., & Guez, L. (2017). Inversionistas de Impacto en Chile: Mercado y variables de inversión. Accessed here.

2 Ibid.

3 Aninat, M., Vallespin, R., & Villar, R. (2020). Hacia un nuevo marco legal para las donaciones: análisis comparado Chile, América Latina, OCDE. Accessed here.

4 These indicators are assessed periodically in formal meetings that both parties hold every six months.

Innovative factors

Fundación Mustakis’s innovations are linked to its hybrid role as an implementer and as a funder. Its programs are focused on a comprehensive development of children and youth while using donations to fund organizations and third-party programs that address social and/or environmental problems other than those related to its core areas of direct support. The venture philanthropy approach and systemic connotation in the Foundation’s work entails an untraditional vision of how foundations and donations traditionally work.

"A fund format does not work for everyone. We need to start developing various formats that may better impact the different growth stages of the organizations we seek to support".

Patricio Mayr

Administration and Control Manager, Fundación Mustakis

Fundación Mustakis’s business support processes have been perfected and institutionalized. The Foundation currently has three programs:

Incubation: This program supports business ideas and social interventions through seed capital and training and non-financial support over a semester on topics such as theory of change, results measurement, legal structure, communication, access to state benefits, and access to finance. Training is done mainly in groups, but customized guidance is also provided on a monthly basis. This program delivers up to $14,000 USD each year.

Acelera2: This is a program running since 2021 aimed at organizations that have participated in the incubation program. The goal is to develop business skills and build a comprehensive business model. The University of Chile leads all the business strengthening training. This program has been reinforced by lessons learned from Latimpacto,5 highlighting the non-financial support organizations need to use capital in such a way that impact and sustainability can be enhanced.

Scalling: This program supports organizations with a longer track record and more experience and larger budgets, such as Techo Chile,6 In which, for example, more than $150,000 USD is given to projects for up to three years. The budget is unearmarked that allows to identify the needs and define the aspects that must be strengthened through mentors who specialize in each area of strengthening and who are part of Fundación Mustakis’s partner directory.

"Financial support is not enough in and of itself. Organizations usually lack the networks and experience a large organization can provide them. We have learned to systematize these formats by listening and understanding what we can create through our interventions. We have realized that non-financial support is even more important: the key support for interactions."

Patricio Mayr

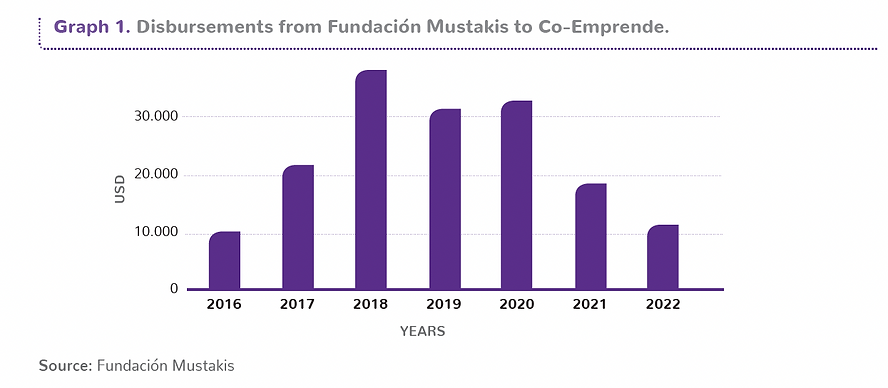

The range of resources fixed for each of the Foundation’s programs includes an annual amount to be granted through donations, which is determined along with the beneficiary organization. This amount increases over the first stages and then decreases to give way to the exit process, considering that Fundación Mustakis seeks to help organizations reach an independent and sustainable business model. In the case of Co-Emprende, donations made between 2016 and 2022 amounted to $163,345 USD and were allocated to the organization’s operation and development and the seed capital provided to social businesses. A breakdown of the disbursements made to Co-Emprende since 2016 can be seen in Graph 1.

%203_41_52%20p_%C2%A0m_.png)

Additionally, within the scope of action related to the Chilean legal framework, the Foundation’s innovations are linked to resorting to an endowment for financial sustainability. This is an innovative mechanism to sustain and finance non-profit organizations, and in this case, it has produced enough returns to its endowment to finance the Foundation’s entire operation.

%203_42_21%20p_%C2%A0m_.png)

In addition to the Foundation’s finance goal, which is based on its endowment, these investments have been seen as a new way to generate impact. For example, the Foundation started investing in funds meeting environmental, social, and governance (ESG) criteria in 2013 and, since 2017, it has committed to using 10% of its endowment in sustainable and impact investments, often producing returns above the market. By the end of 2022, 20% of the organization’s investments are expected to be made under this approach.

““For foundations with an endowment, socially responsible or impact investments are an alternative that enables them to use their resources to contribute to the well-being of the community while achieving the necessary returns to finance their own social programs or make donations”.

Fundación Mustakis, 2019 Report.7

5 Such as its 2021 study: Social Investment and Impact: Cases and Trends in Latin America.

6 For more information, go to: https://cl.techo.org/.

7 Fundación Mustakis (2020). Memoria 2019. Accessed here.

Lessons

The goal of financial and non-financial support is to consolidate a sustainable business model for organizations. In comparison with 2020, we can see that, in the case of end beneficiaries, i.e., social businesses directly supported by Co-Emprende:

There is greater impact on information recording (inventory control, sales and purchases, and indirect costs).

All microentrepreneurs identify their strengths and weaknesses.

There is greater impact on the businesses’ digital marketing.

Businesses saw an increase in average sales of more than $950 USD8, compared with an average of $421USD9 in 2020.

There is a greater impact on microentrepreneurs’ savings: 86% compared with 56% in 2020.

Three new jobs created in four months compared with two in the 2020 six-month program.

However, there is still a challenge in better understanding how such impact is reflected on Co-Emprende as the beneficiary, and not only through the end beneficiaries. Similarly, Co-Emprende could improve by defining a more specific exit strategy to reach the expected sustainability. Until this date, three more enterprises have been financed, yet diversifying income and achieving financial sustainability remains a challenge.

Another challenge is using new financial instruments beyond donations to help other organizations and projects within the action line of supporting social businesses. Nevertheless, one of the key takeaways is that financial support must go hand in hand with guidance and non-financial support, which must be defined, structured, and systematized together with financial support. This is why the Acelera2 program might be made available to organizations that participated in the scaling program, as non-financial support is highly focused on structuring sustainable business models. In addition, the importance of having different types of funds adapted to the needs of organizations and initiatives throughout their various development stages is also critical.

Thanks to Fundación Mustakis’s expertise in supporting social businesses, its innovative approach relies on having an independent use of capital, especially during the incubation program to try out business ideas and interventions with absolute flexibility, adaptability, and freedom throughout the process. This could be enhanced by the adding other investors, a path that the Foundation will pursue in the future.

8 CLP 850,000 (conversion based on a rate of CLP 1,000 to USD 1.17).

9 CLP 360,000 (conversion based on a rate of CLP 1,000 to USD 1.17).