Deetken Impact

Innovating the way to invest

Deetken Impact

Innovating the way to invest

Regional / Investor

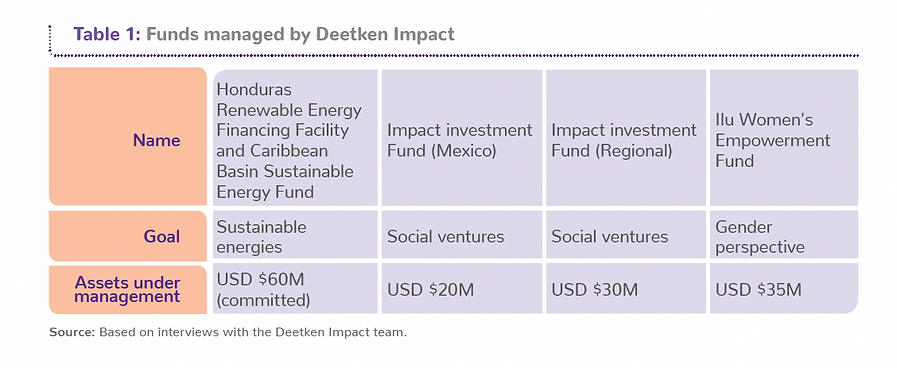

Deetken Impact, a manager and administrator of impact investment funds based in Canada, has focused its investments in Latin America and the Caribbean to attend initiatives that seek to solve social and environmental problems. It currently manages resources for USD 150 million in five funds and has made 49 investments in 14 countries in the region. Over the years, Deetken Impact has developed expertise in gender-lens investing and revenue-based financing.

%2010_34_33%20p_%C2%A0m_.png)

Overview

The prospects for economic growth in Latin America and the Caribbean for 2022 show a marked slowdown in the pace of expansion compared to what was presented in 20211. In addition to the steep global trend of slowdown - due to the economic contraction due to the Covid-19 pandemic- inflation, debt and income inequality is increasing, a scenario perceived by the World Bank as a threat to the recovery of emerging and developing economies in the region.2

Aspects such as the recovery of post-pandemic jobs continue to be highly inequitable, while unemployment rates for women remain at levels higher than those for men. Working women, as a result of the pandemic, are 44% more likely to lose their job and twice as likely to give up their job search compared to men.

One of the main engines of economic recovery in the region are micro, small, and medium-sized enterprises (MSMEs); however, their financing deficit is three times higher than the current volume of available resources.3 Private investment can play a relevant role in promoting its growth in the region. However, traditional investment approaches are inadequate to meet the needs and characteristics of a context that demands innovation and flexibility to support growth, without losing sight of impact objectives.

Deetken Impact has stood out as one of the impact investment companies that has focused its investment decisions on Latin America and the Caribbean, recognizing the importance of access to capital as an instrument to capture and nurture economic growth.4 Incorporated in Canada, Deetken Impact has focused its investments on businesses and impact companies that promote entrepreneurship, provide or improve access to basic services, especially in vulnerable or marginalized populations, and have a positive environmental impact. This fund manager has attempted to explore opportunities for growth in various sectors that have a significant impact on the communities of the region, such as financial inclusion encompassing microfinance and missing middle –small and medium-sized impact companies with unsatisfied financing needs–,empowerment of women through entrepreneurship, renewable energy, affordable housing,education, health services, sustainable production and consumption, and circular economy.

Deetken Impact’s investment decisions are guided by a long-term horizon, a global perspective, and a commitment to ethical business practices, maximizing returns for investors and generating a positive impact in the communities in which they are invested. This has been possible thanks to the definition of six investment objectives that govern the operation of the organization:

Generate exceptional long-term value for investors.

Earn attractive returns adjusted to risks and investing in a diversified portfolio in the region.

Generate significant and measurable social and environmental impact by investing in projects in each of thethe prioritized sectors.

Apply a gender perspective in the investment process to evaluate and advance practices that allow achieving gender equality in the region and promote diversity within the team itself.

Offer a platform of financing instruments that offers both the variety and the flexibility to meet the diverse and unmet needs for financing in a variety of businesses, seeking sustainable growth without risking impact objectives.

Provide personalized non-financial support.

As of May 2022, Deetken Impact had 49 completed investments in 14 countries in the region, as a result of managing five funds.

%2010_35_12%20p_%C2%A0m_.png)

"The [investment] opportunities that we have identified in Latin America have [both] a more significant impact, especially in terms of gender equity and environmental sustainability, [as well as] better financial returns than those that can be found in other markets."

Alexa Blain

Managing Partner, Deetken Impact.

On the other hand, Deetken Impact has also been concerned with advancing in the consolidation of an investment ecosystem in the region that contributes to gender equality. The organization recognizes that promoting gender equality is critical to achieving each of the 17 Sustainable Development Goals (SDGs) and accelerating social and environmental progress, as women are key drivers of prosperity.

It also recognizes that diversity and inclusion drive better business performance, including better profitability, more innovation, higher employee satisfaction and retention, and higher returns for investors. For this reason, they consider that investment with a gender approach not only favors the consolidation of a systemic change necessary for sustainable development and poverty reduction, but also improves investment and business performance. For this purpose, in partnership with Pro Mujer5, Deetken Impact launched the first fund with a gender focus in Latin America and the Caribbean, the Ilu Women’s Empowerment Fund (Ilu Fund)6.

1 CEPAL, 2022. Latin America and the Caribbean will slow down its growth to 2.1% in 2022 amid significant asymmetries between developed and emerging countries. Available here.

2 World Bank, 2022. Global growth will slow until 2023, adding to the risk of a “hard landing” in developing economies. Available here.

3 SME Finance Forum (2022). Finance gap in Latin America and the Caribbean. Available here.

4 Deetken Impact, About. Available here.

5 Pro Mujer (PMI) is an organization that provides services for the productive inclusion of women in Latin America, especially through microcredit and the expansion of access to primary health and education to enhance the impact on clients. [See Pro Woman case].

6 Deetken Impact, Empowering Women. Available here.

Innovated aspects

The structuring of the Ilu Fund represents one of the most innovative aspects within the operation of Deetken Impact, not only for concentrating on the provision of financing to contribute to gender equality in the region, but also for implementing mechanisms and systemic practices of intelligent investment with a gender focus, which have been structured in conjunction with Pro Mujer. This system is made up of five gender lenses that serve as instruments for investment decisions: Women in Leadership, Equity in the Workplace, Products and Services that Benefit Women and Girls, Advocacy and Equity in the Value Chain, and Community Engagement.

Within this system, it is not only important to invest in organizations that stand out in the use of these lenses, but also in those where there is a clear commitment on the part of management and the governing bodies to implement better gender practices. For this, it works with the investees before signing an investment contract, evaluating gender practices in the five lenses and identifying strengths and opportunities for improvement. Specific and actionable gender goals are then set and agreed upon to advance the institution’s gender practices and improve its impact on women. Finally, the commitments undertaken are included within the loan contracts, and although they are not binding, this guarantees that they are a key part of the agreement.

The relationship that Deetken Impact has built with Pro Mujer has been far reaching. Both organizations joined forces to set up the Gender Smart Committee, where the aforementioned criteria are evaluated with respect to each potential investment independently of the investment committee. In 2022, it was decided to integrate both committees into one, without this implying a loss of participation of Pro Mujer or of the criteria themselves. This organization has undertaken an active role in the identification of investment opportunities with a gender approach, company evaluation and investment decisions.

"We identified that in the markets in which we operate, it was necessary to have support in terms of incubation and acceleration to bring the projects to a point of readiness for investment".

Alexa Blain

Currently, Deetken Impact has three technical assistance facilities. On the one hand, the Ilu Women’s Empowerment Program, developed with the support of USAID’s Gender Equality and Women’s Empowerment Hub program, and in collaboration with Pro Mujer, to promote gender equality in Latin America.

Its objective is to address the main obstacles to the adoption of gender-responsive business and investment practices in the region and thus drive systemic change through three main components: incremental capital, expanding the Ilu Fund with risk-adjusted blended finance; providing investees with direct non-financial support to develop and strengthen business practices; and dissemination and promotion of knowledge to promote the investment ecosystem with a gender approach, developing an open source toolkit, hosting regional workshops, leading investor education events, and sharing case studies.

Through these components, the Ilu Fund team directly impacted more than 1,000 participants in the continent, and also:

Raised USD 5.8M in blended finance, 80% of which came from new investors in the Fund.

Implemented 15 technical assistance projects in 9 countries in Latin America and the Caribbean, with a total of almost 500 participants, of which 64% identify as women.

It built a set of open-source tools, 27 of which provide practical guidance, templates, and recommendations for advancing gender practices.

It delivered 17 regional workshops and webinars that reached more than 500 participants.

Developed training for investors, reaching more than 800 people throughout the American continent.

It produced 3 case studies that highlight the importance of technical assistance on gender.

On the other hand, in partnership with USAID, Deetken Impact developed the Investment, Business and Sustainability (INES) program, which seeks to accelerate economic opportunities for job creation and address some of the root causes of irregular migration in El Salvador.

The organization also has technical assistance for renewable energy projects managed by the IDB Lab and provided by the Scaling Up Program for Renewable Energy in Low-Income Countries (SREP). With it, promising projects in Central America are incubated and strengthened through the provision of pre-investment support services, including capacity building in social and environmental management, collaboration with the community and impact management, as well as dissemination and promotion of knowledge.

Deetken Impact offers support to the boards of directors of the financed companies, getting involved in them and concentrating in particular on the formulation of technical recommendations for the composition of inclusive governance schemes. The nature of its participation depends on the financial instrument with which each company is financed,7 but it usually takes place with a position in said governing body, which allows establishing efficient and close recommendations to scale its impact.

"It has been fascinating to interact and be part of the training that we have carried out with the boards of directors of the companies in the Ilu Fund portfolio and to understand how they see gender practices and the need to be much more inclusive and diverse in their organizations."

Magali Lamyin

Managing Partner, Deetken Impact.

In its management, monitoring and impact measurement practices, Deetken Impact implements impact measurement metrics that align its objectives, those of the companies that receive investments, and the Sustainable Development Goals.

The flexibility of the financial instruments that Deetken Impact offers constitutes another innovative element of its operation. Within each of the funds, investment decisions are made to meet the financing needs of companies and enterprises, in such a way that they allow them to scale impact without sacrificing financial return or the socio-environmental mission.

For example, Deetken Impact is a pioneer in the use of revenue-based financing as a wat to meet the need of SMEs in the region with difficulties in obtaining financing from providers of commercial debt, venture capital and private equity, providing financing alternatives that can help them grow sustainably. In addition, it has incorporated blended finance schemes, especially from the combination of resources coming from financial capital institutions, private sector capital and even first-loss catalytic capital. For the Ilu Fund, Deetken Impact and Pro Mujer structured first-loss capital that provided greater security to investors, allowing them to expand the fund by USD 5.8 million after the pandemic.

7 For example, if you grant senior debt directly, you don’t necessarily have that seat on the board of directors.

Lessons

The sustained and significant growth that Deetken Impact has had in the last decade, going from managing a small pilot fund to reaching the capacity to manage its five funds with a relatively small team of 27 people, has been possible for two reasons. First, the organization has been effective in setting up strategic relationships with various actors such as incubators, accelerators, international development organizations, funds and fund managers, communities, and companies. This synergistic work has made it possible to focus and scale the impact of Deetken Impact. An example of this is the participation of people from the organizations in which Deetken invests —such as representatives of Pro Mujer— in committees where investment processes and decisions are made.

Second, the organization has consistently sought in its investment decisions to maintain a balance between financial return and impact. This has allowed it to offer its investors predictable and stable returns, even presenting competitive rates of return compared to the market.8 This has affected the attraction of new investors who traditionally do not invest in impact, such as family offices, foundations and even individuals. These investments, by June 2022, have reached a number of more than 740,000 micro-enterprises or SMEs supported, having impacted more than 1 million people.

"We are convinced that it is not necessary to sacrifice return to boost impact. When the generation of positive impacts is a comprehensive part of the business model, this balance occurs organically."

Magali Lamyin

In addition, with the aim of maintaining this same focus despite the pressures of the economic and social crisis derived from the Coivd-19 pandemic, Deetken Impact has sought to diversify and optimize its portfolio to mitigate the uncertainty generated.

The challenges identified by this organization especially concentrate in two fields: impact management and consolidation of the provision of non-financial support. Regarding the former, the homogenization of impact measurement practices and instruments applicable to the different sectors represents a challenge when it comes to jointly establishing the performance goals of each of the funds around the different companies and projects financed. The organization finds an opportunity to advance in the consolidation of more precise and robust data of each of these in order to have a better picture of the impact.

Regarding non-financial support, the organization has realized that the enterprises require a lot of support. However, because the demand exceeds its response capacity, it has developed alliances to expand the capacity.

8 For example, since the launch of the ILU Women’s Empowerment Fund, Deetken Impact has provided stable returns of 6% in USD, including the effects of the pandemic.